colorado springs vehicle sales tax rate

The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. Motor vehicle dealerships should review the DR 0100 Changes for Dealerships document in addition.

This Is The Most Expensive State In America According To Data Best Life

See Department publication Colorado SalesUse Tax Rates DR 1002 for service fee percentages for state-administered local sales taxes.

. This is the total of state county and city sales tax rates. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county. The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax.

290 Is this data incorrect Download all Colorado sales tax rates by zip code. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state. When purchasing a new.

Maximum Possible Sales Tax. The December 2020 total local sales tax rate was 8250. Sales Use Tax Topics.

The current total local sales tax rate in Colorado Springs CO is 8200. Owners may be subject to. The average cumulative sales tax rate in Colorado Springs Colorado is 724.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. A Colorado Springs resident owns a home in the C ity and a ranch in the mountains. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

What is the sales tax rate in Colorado Springs Colorado. 1 2021 the new City of Colorado Springs sales and use tax rate will be 307 for all transactions. How to Calculate Colorado Sales Tax on a Car.

The vehicle is principally operated and maintained in Colorado Springs. Colorado Springs is located within El Paso. The minimum is 29.

Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Average Local State Sales Tax. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle.

Colorado State Sales Tax. The ownership tax rate is assessed on the original taxable value and year. Multiply the vehicle price.

The following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in effect. Effective July 1 2022. This is the total of state county and city sales tax.

Ownership tax is in lieu of personal property tax. Recent Colorado statutory changes require retailers to charge collect and remit a new fee. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail.

This includes the rates on the state county city and special levels. The minimum combined 2022 sales tax rate for Pagosa Springs Colorado is. You can print a 82.

Maximum Local Sales Tax. What is the sales tax rate in Pagosa Springs Colorado. Vehicles do not need to be operated in order to be assessed this tax.

The extension is at a reduced tax rate of 057 down from 062. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

North Carolina Sales Tax Guide For Businesses

Sales Tax Information Colorado Springs

Sales Tax City Of Fort Collins

How Colorado Taxes Work Auto Dealers Dealr Tax

2022 Sales Tax Holidays Back To School Tax Free Weekend Events

How Colorado Taxes Work Auto Dealers Dealr Tax

Wyoming Sales Tax Small Business Guide Truic

Taxation In Castle Pines City Of Castle Pines

Colorado Sales Tax Rates By City County 2022

Kansas Sales Tax Rates By City County 2022

Florida Sales Tax Rates By City County 2022

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

How Colorado Taxes Work Auto Dealers Dealr Tax

The Consumer S Guide To Sales Tax Taxjar Developers

Are You Looking For New Tax Deductions On This Years Us Federal Income Taxes Let Your Rv Help You Save More Money On Your Taxes Fin Tax Deductions Rv Rv Life

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

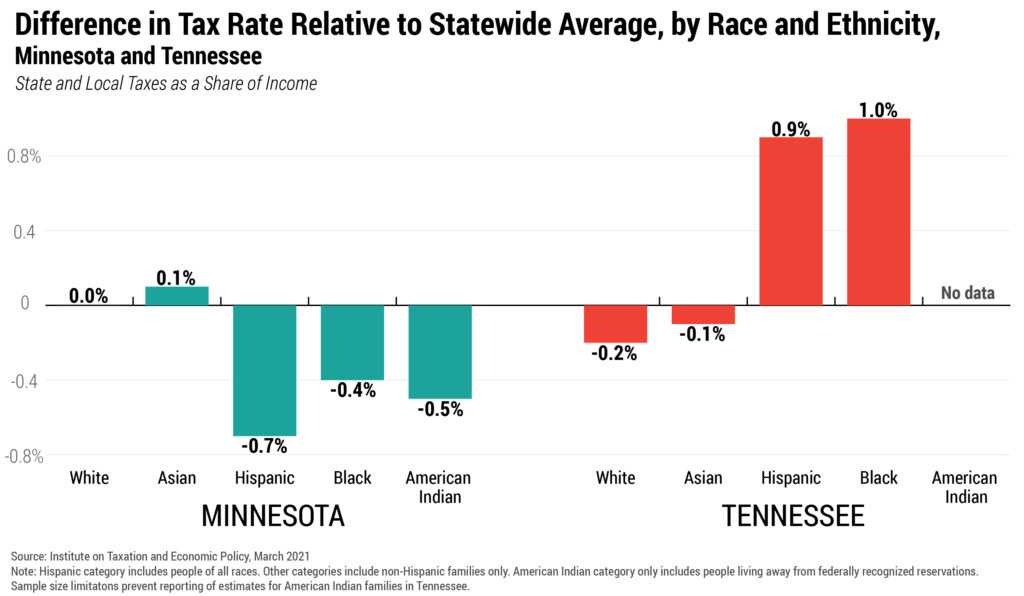

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep